You Work Hard. Let Your Money

Work For You!

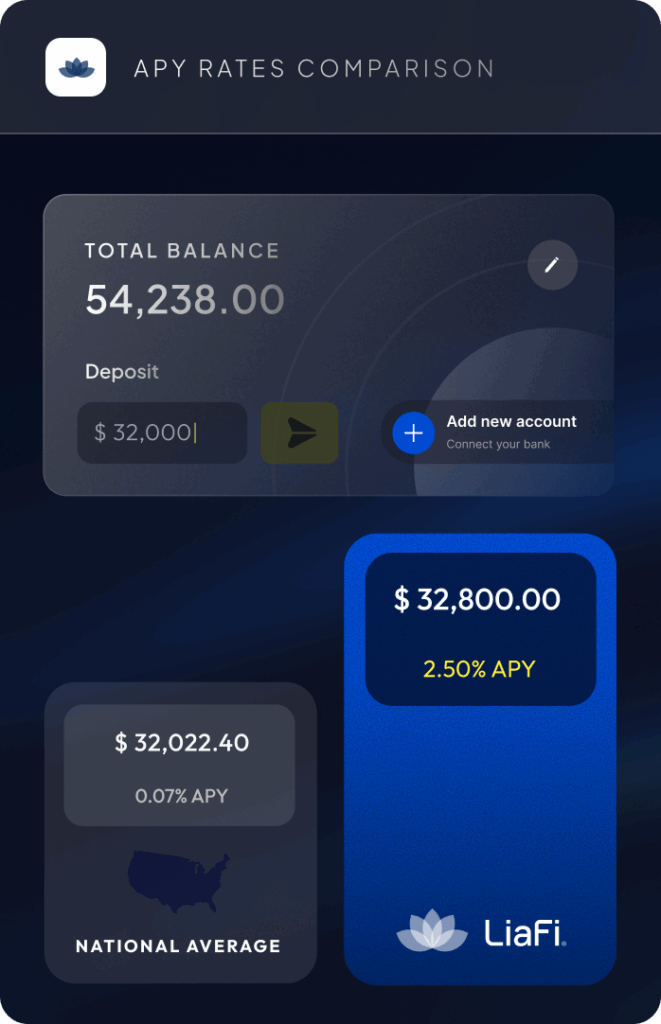

LiaFi is a platform that helps small businesses grow their cash reserves. With a LiaFi business account

you’ll earn 2.50% Annual Percentage Yield*. More money from us is more freedom for you.

*Annual Percentage Yield subject to change at any time.

1 As of 11/28/25 www.chase.com/content/dam/chase-ux/ratesheets/pdfs/rbor1.pdf

2 As of 12/01/25 https://business.bankofamerica.com/en/deposits/checking-accounts

3 As of 12/4/25 https://www.usbank.com/business-banking/banking-products/business-bank-accounts/business-checking-account/todays-business-checking-rates.html

4 National interest checking deposit rate comparison as of 11/17/25 from https://www.fdic.gov/national-rates-and-rate-capsMember FDIC. APY is variable and may change.

You Work Hard.

Let Your Money

Work For You!

LiaFi is a platform that helps small businesses grow their cash reserves. With a LiaFi business account

you’ll earn 2.50% Annual Percentage Yield*. More money from us is more freedom for you.

*Annual Percentage Yield subject to change at any time.

1 As of 11/28/25 www.chase.com/content/dam/chase-ux/ratesheets/pdfs/rbor1.pdf

2 As of 12/01/25 https://business.bankofamerica.com/en/deposits/checking-accounts

3 As of 12/4/25 https://www.usbank.com/business-banking/banking-products/business-bank-accounts/business-checking-account/todays-business-checking-rates.html

4 National interest checking deposit rate comparison as of 11/17/25 from https://www.fdic.gov/national-rates-and-rate-capsMember FDIC. APY is variable and may change.

Keep Your Liquidity. Easy Transfers.

LiaFi is a financial technology company.

LiaFi deposits are FDIC-insured through Magnolia Bank, Member FDIC.

Keep Your Liquidity. Easy Transfers.

LiaFi is a financial technology company.

LiaFi deposits are FDIC-insured through Magnolia Bank, Member FDIC.

Some Banks Advertise High APY*.

Then Hit You With The Fine Print.

Some Banks Advertise

High APY*.

Then Hit You

With The Fine Print.

Typical High-Yield Account Features

How LiaFi is Different

Promotional ‘Up to’ APY With a Catch

Tiered rates

Intro periods

High minimums

Transfer limits

Straightforward APY. No Fine Print

No minimums to get APY

No platform fees

No lockups

You approve every transfer

Keep your bank. Connect one or many accounts.

Typical High-Yield Account Features

Promotional ‘Up to’ APY With a Catch

Tiered rates

Intro periods

High minimums

Transfer limits

How LiaFi is Different

Straightforward APY. No Fine Print

No minimums to get APY

No platform fees

No lockups

You approve every transfer

Keep your bank. Connect one or many accounts.

LiaFi is not a bank. Banking services by Magnolia Bank. Deposits FDIC-insured up through Magnolia Bank, Member FDIC. APY is variable and may change.

LiaFi is not a bank. Banking services by Magnolia Bank. Deposits FDIC-insured up through Magnolia Bank,

Member FDIC. APY is variable and may change.

You might be losing out without realizing it

Use the calculator to see what you could be earning.

Total

*This Calculator Is For Educational Purposes Only. Please Note That The Estimated APY Is Subject

To Change, Which May Impact Your Total Earnings.

You might be losing out without realizing it

Use the calculator to see what you could be earning.

Total

*This Calculator Is For Educational Purposes Only. Please Note That The Estimated APY Is Subject

To Change, Which May Impact Your Total Earnings.

TESTIMONIALS

Don't Just Take Our Word For It...

TESTIMONIALS

Don't Just Take Our Word For It...

Brett H.

"I don’t want to think about how much interest I missed out on"

"I regularly had well over $100,000 just sitting there earning nothing. For years. I assumed that was normal unless you wanted to lock the money up in a savings account. LiaFi is so simple, I wish I’d started sooner. I dread to think how much I could’ve earned before.”

Small Business Owner

Marianne

"Now my extra cash is actually doing something"

"I’m constantly juggling everything in my business, managing spare cash just wasn’t on my radar. Now I keep enough cash in my checking account to cover upcoming expenses and put the rest in Liafi to make money.”

Small Business Owner

Don’t Just Save. LiaFi.

It’s that simple

Don’t Just Save. LiaFi.

It’s that simple

LiaFi your idle cash from

your existing bank

accounts

Sign up for LiaFi completely online in just a few minutes,

then securely link all your existing business bank accounts

in two clicks.

LiaFi your idle cash from your

existing bank accounts

Sign up for LiaFi completely online in just a few minutes, then securely link all your existing business bank accounts in two clicks.

Book A Free DemoStart earning 2.50%

APY* on your cash

LiaFi tracks your account activity and shows when cash is idle, letting you move it to a high-yield, FDIC-insured account. So your money starts working, while you stay in control.

Book A Free DemoStart earning 2.50% APY*

on your cash

LiaFi tracks your account activity and shows when cash is idle, letting you move it to a high-yield, FDIC-insured account. So your money starts working, while you stay in control.

Book A Free DemoGet it back whenever you

need it

Need your cash for an unexpected bill? No problem. Easily transfer it back to your account when you need it, while keeping the interest you’ve earned.

Book A Free DemoGet it back whenever

you need it

Need your cash for an unexpected bill? No problem. Easily transfer it back to your account when you need it, while keeping the interest you’ve earned.

Book A Free DemoYour money can do more for you.

2.50% APY* more growth, that is.

With LiaFi, you get the financial tools you need to accelerate growth, and improve your

cash flow for the things that matter.

Your money can do more for you.

2.50% APY* more growth, that is.

With LiaFi, you get the financial tools you need to accelerate growth, and improve your

cash flow for the things that matter.

Ease the

financial load

on your

business.

Offset

Expenses

Recharge with a

well deserved

vacation.

Relax

Already

Modernize your

tools to meet your

brand’s needs.

Upgrade

Equipment

Reward your

team with a

bonus.

Show

Appreciation

Great rates are just the

beginning.

We help businesses stay ahead of the curve.

Being a financial technology company allows us to remain flexible. We’re able to adapt to changing market conditions and consumer preferences.

Because we don’t have physical branches to maintain and operate,

we can develop and launch new products and services faster and

with lower costs. Those savings get passed on to our customers.

Great rates are just the

beginning.

We help businesses stay ahead of the curve.

Being a financial technology company allows us to remain flexible. We’re able to

adapt to changing market conditions and consumer preferences.

Because we don’t have physical branches to maintain and operate,

we can develop and launch new products and services faster and

with lower costs. Those savings get passed on to our customers.

How do you protect my money, and

other important questions

How do you protect my money, and

other important questions

1. Is my money protected?

Yes. Cash moved to LiaFi earns interest in FDIC-insured accounts, provided by Magnolia Bank.

2. Can I access my money quickly if I need it?

You can move funds to and from your linked business checking anytime. Timing can vary based on cutoff times and your bank. (Your bank may charge fees for wires/expedited transfers.)

3. When do I start earning interest, and when is it paid?

Interest starts accruing on the business day your funds settle at Magnolia Bank. Interest is calculated daily and credited monthly. APY is variable and set by Magnolia Bank and may change at any time.

4. Why can’t my bank just do this for me?

Many business checking accounts pay little or no interest on operating balances. LiaFi sits alongside your existing checking and allows you to move surplus cash to an interest-earning account at Magnolia Bank—so you don’t have to switch banks to earn on idle cash. If your bank already offers a comparable solution that fits your needs, great—LiaFi is an easy alternative that keeps your current banking unchanged.

5. I already have a business savings account, why would I use LiaFi?

Use LiaFi if you want yield + flexibility without moving banks. It connects to your existing checking, pays a competitive APY on idle cash, and keeps funds accessible when you need them. If your current savings already gives you a comparable rate, access, and workflow, LiaFi may be redundant—but for many businesses it’s a simpler, higher-yield companion to checking.

1. Is my money protected?

Yes. Cash moved to LiaFi earns interest in FDIC-insured accounts, provided by Magnolia Bank

2. Can I access my money quickly if I need it?

You can move funds to and from your linked business checking anytime. Most ACH transfers complete the next business day; timing can vary based on cutoff times and your bank. (Your bank may charge fees for wires/expedited transfers.)

3. When do I start earning interest, and when is it paid?

Interest starts accruing on the business day your funds settle at Magnolia Bank. Interest is calculated daily and credited monthly. APY is variable and set by Magnolia Bank and may change at any time.

4. Why can’t my bank just do this for me?

Many business checking accounts pay little or no interest on operating balances. LiaFi sits alongside your existing checking and allows you to move surplus cash to an interest-earning account at Magnolia Bank—so you don’t have to switch banks to earn on idle cash. If your bank already offers a comparable solution that fits your needs, great—LiaFi is an easy alternative that keeps your current banking unchanged.

5. I already have a business savings account, why would I use LiaFi?

Use LiaFi if you want yield + flexibility without moving banks. It connects to your existing checking, pays a competitive APY on idle cash, and keeps funds accessible when you need them. If your current savings already gives you a comparable rate, access, and workflow, LiaFi may be redundant—but for many businesses it’s a simpler, higher-yield companion to checking.

Start earning interest on the cash your

business isn’t using

Open a LiaFi account and earn 2.50% APY* on idle cash without switching banks, locking up funds, or paying monthly fees.

Easy online application

Sign up in just 5 mins

APY accurate as of July 24, 2025. Rate is variable and subject to change.

Start earning interest on the cash your

business isn’t using

Open a LiaFi account and earn 2.50% APY* on idle cash without switching banks, locking up funds, or paying monthly fees.

Easy online application

Sign up in just 5 mins

APY accurate as of July 24, 2025. Rate is variable and subject to change.

Banking & FDIC* Info

LiaFi is a financial technology company, not a bank. Banking services are provided by Magnolia Bank, Member FDIC.

APY* Details

The 2.50% Annual Percentage Yield (APY) is accurate as of July 24, 2025, and may change at any time without notice. The disclosed APY assumes that principal and interest remain on deposit for the full term. Actual earnings may vary based on balance and activity.

Terms & Disclaimers

LiaFi does not provide investment, tax, or legal advice. To earn the advertised APY, funds must be actively transferred to your LiaFi account. Withdrawals are typically available quickly. FDIC insurance applies only to settled funds held with Magnolia Bank.

Banking & FDIC* Info

LiaFi is a financial technology company, not a bank. Banking services are provided by Magnolia Bank, Member FDIC.

APY* Details

The 2.50% Annual Percentage Yield (APY) is accurate as of July 24, 2025, and may change at any time without notice. The disclosed APY assumes that principal and interest remain on deposit for the full term. Actual earnings may vary based on balance and activity.

Terms & Disclaimers

LiaFi does not provide investment, tax, or legal advice. To earn the advertised APY, funds must be actively transferred to your LiaFi account. Withdrawals are typically available quickly. FDIC insurance applies only to settled funds held with Magnolia Bank.